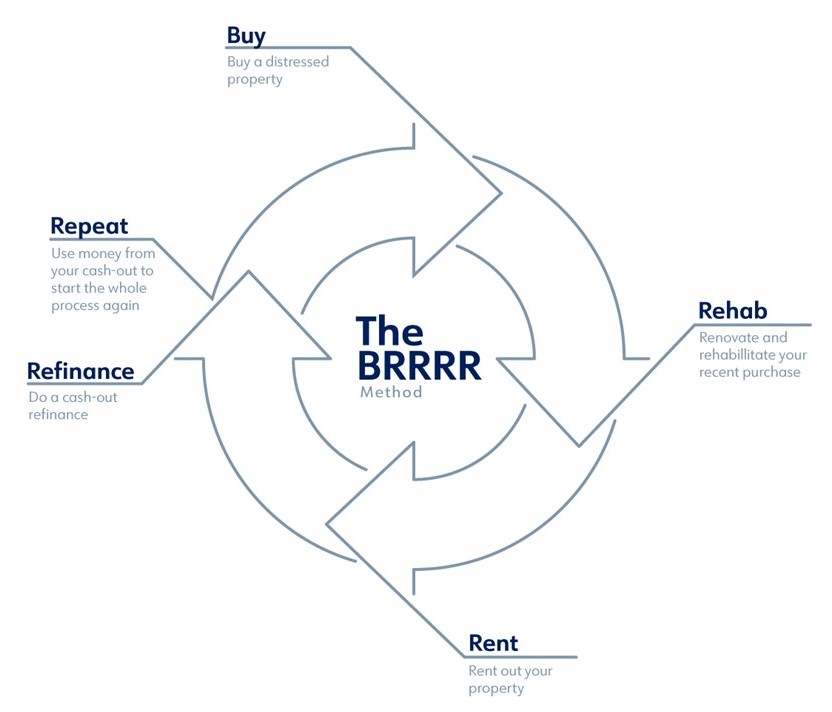

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Out of State Investing

Do I Need Asset Protection for My Rental Properties?

What Is Real Estate Asset Protection? Asset protection in real estate is exactly what you’d expect: it protects you and your investments incase any unfortunate situations arise. The last thing any investor wants after spending his or her hard earned money […]

read more

read more

Questions to Ask Before Hiring a Property Manager

Are you thinking of hiring a property management company? Then you need to ask the right kind of questions. With the right questions, you stand a high chance of selecting an efficient, effective and reputable property management company. Here are […]

read more

read more

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Majority of Renters Plan to Stand Pat

Rents may be rising and consumers may be feeling the crunch when it comes to their personal finances, but 70 percent of renters still believe that renting is more affordable than owning a home and 55 percent of renters plan […]

read more

read more

6 Reasons to Invest in Single-Family Homes

Making investments to build wealth and secure your future is very important, and an excellent way to add to your portfolio is through real estate ownership. When you first get into property investment, though, there’s one big question you’ll need […]

read more

read more

Renting vs. Buying for Millennials: 3 Cities to Consider

While buying is largely considered financially savvier than renting on a national level due to almost historically low interest rates and increasing rents in major metros, loan restrictions and struggling to save for a down payment while renting delays homeownership […]

read more

read more